As we launch into the first edition of our latest newsletter, “Charting the Ascent,” I’m going to share some knowledge with you, grammar police be damned: Once you know it, you can’t un-know it. The meaning of the phrase “begging the question” is a controversial topic, and I’m one of many who will silently judge you when you use it incorrectly. Miriam Webster has a great article “Beg the Question: It’s not begging at all” (Link below) on the idea.

Most will recognize the phrase to mean “prompting the question” on the heels of a statement or supposition that inspires the need for more information. However, the original phrase comes from a 16th century translation of Aristotle’s “petitio principii,” pointing out a logical fallacy, which is better known as “assuming the conclusion.”

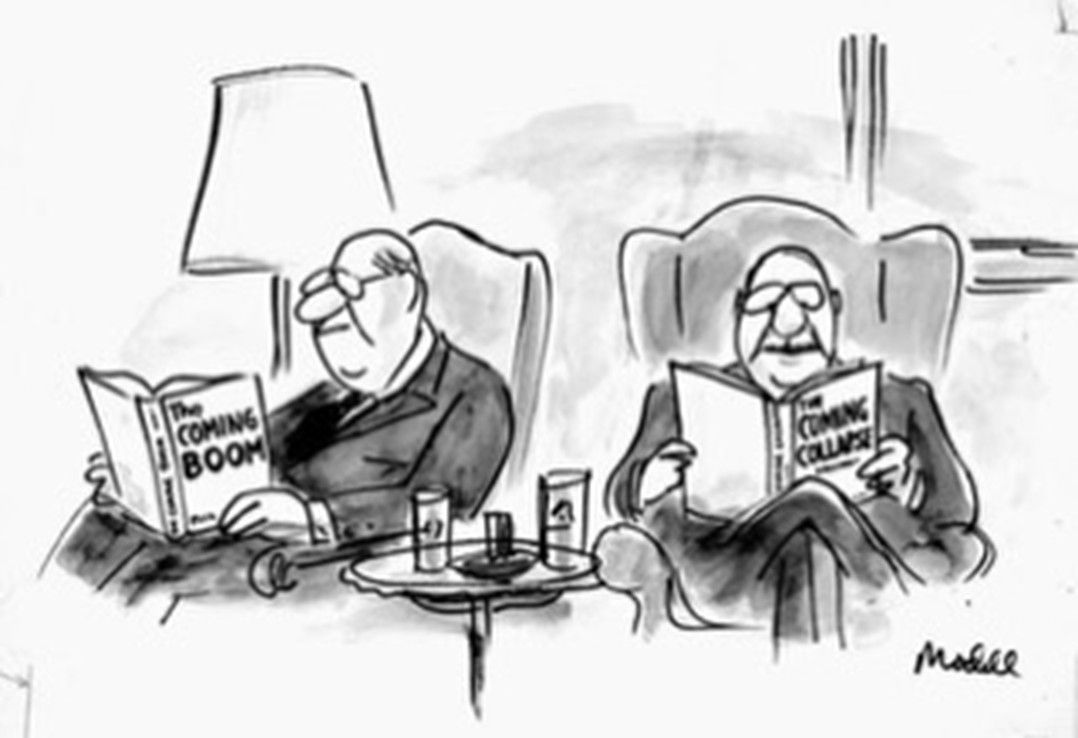

Aristotle’s translated version of “begging the question” is the idea that your argument or thesis is correct on the assumption that the thing you are trying to prove is already correct. Most uses of this version are found in philosophy—a example is “black cats are bad luck and therefore would make a bad pet,” begging the question that black cats are unlucky. So-called mainstream financial “gurus” are constantly guilty of this fallacy, because the future is so uncertain.

Some examples of advice that is incorrect, outdated or otherwise include:

– “A good mutual fund will average 12% annually, so you can sustainably withdraw 8% annually from your portfolio.” This is a flawed argument that will cause more than one retiree to outlive their wealth.

- “Stocks must go (up/down) because my preferred political candidate (won/lost) the election,” is a particularly tempting argument for most. Historical data proves that party doesn’t really matter when it comes to the market’s performance, since it is non-partisan.

- “Warren Buffett is stockpiling cash so it’s a good idea for me to stockpile cash,” is one we hear all the time. As I mentioned earlier in this newsletter, markets may be uncertain, but it’s highly likely your financial situation does not mirror Buffett’s, even if you’re a high-net-worth or ultra-high-net worth investor.

- “Even a small investment in Bitcoin would turn into a sizeable return with our 2030 price target of $682k.” This one also prompts the question: Do we even want to live in a world where Bitcoin is worth that many (completely destabilized) U.S. dollars, while surrounded by crypto-bros in Lamborghinis? Cringeworthy, no?

Assuming the conclusion is a logical fallacy in an argument, but it’s also something investors must do consistently to be successful. A great example to use is that, we didn’t know it at the time, but investments during the spring of 2020 pandemic were some of the best that we’ll make in our lifetimes.

I can only say that with the benefit of hindsight—but it also was true with other black swan events in market history. If you had invested in airline and travel stocks post-9/11, or banking/financial service securities after the global financial crisis, you likely did well. It’s the same process that keeps us disciplined in owning out of favor private investments while public stocks soared over the last two years. More often than not, we’ll be glad we own something that isn’t working at the present moment. We can’t always accurately predict markets, we can only observe and navigate them via process, relying on history as our guide.

Regent Peak is launching “Charting the Ascent” to communicate these observable historical and current data points to share short- and long-form stories that guide our investment philosophy and strategy. Our investment committee is tasked with making investment decisions on both a broad level for a firm, and on an individual basis for a family. That comes with a great deal of responsibility in a sea of uncertainty, and knowing the pitfalls and challenges of the climb can help you better understand the path of growing and protecting wealth.

We intend to share these stories within the context of three themes:

- Market conditions in context of the macro and micro economy, using third-party and internal investment committee ideas.

- Investment committee processes and decisions around how these market conditions play out or might play out.

- Resources for understanding what you own and why you own it.

We are starting this as a device to add context to what most clients hire us to do—match their investment strategies to their financial goals. I’ve seen investors upset at only being up 17%, and others who are ecstatic being down 8%. I’ve heard investors say: “Why not just own the S&P500?” AND “Why didn’t we beat the S&P500?” Or: “Why don’t I just sell everything and take no risk?” AND “Why aren’t we taking more risk?”

We have heard all kinds of these contrary examples and yet we are managing essentially the same portfolios in different dollar amounts! Clearly, context is needed to help shape how we think about our portfolio, and how it is working for your unique financial circumstances.

https://finance.yahoo.com/news/realistically-dave-ramsey-8-retirement-165222513.html

https://www.nasdaq.com/articles/warren-buffett-holding-cash-should-you

https://finance.yahoo.com/news/heres-much-100-bitcoin-could-185414994.html