Elias John Crist, Associate Relationship Manager

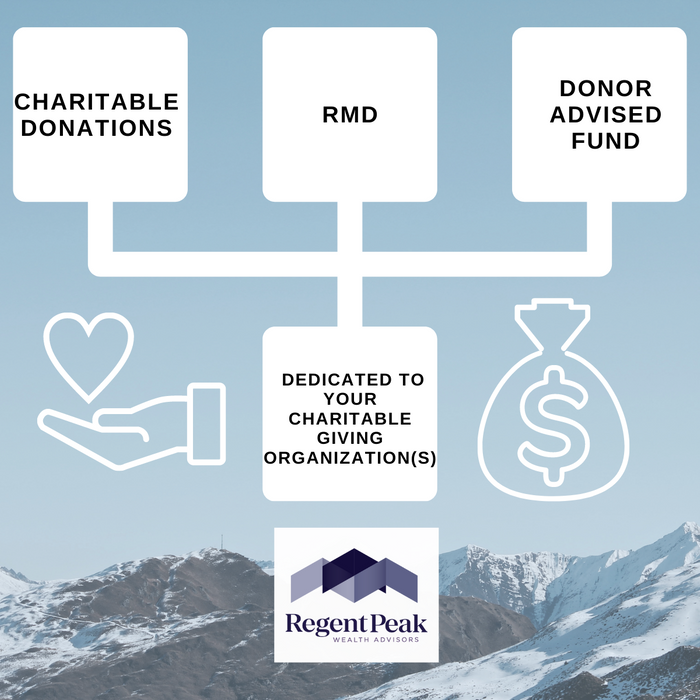

As tax season rolls around, charitable giving may be on your mind. While it is too late to impact your 2021 giving, here are ways to make your charitable giving more tax efficient going forward.

Elias John Crist, Associate Relationship Manager

As tax season rolls around, charitable giving may be on your mind. While it is too late to impact your 2021 giving, here are ways to make your charitable giving more tax efficient going forward.

Gift your RMD through a QCD:

Pros

Formally known as a Qualified Charitable Donation, this amount can be gifted straight from your IRA to a charity of your choice, eliminating the need to take an RMD.

Using the QCD strategy lowers your taxable income dollar for dollar by redirecting the distribution to a charity instead of you and your 1040.

Cons

If you rely on the RMD income for retirement expenses, then giving via the QCD strategy would not make sense.

There is an annual QCD limit of $100,000, so if your RMD is larger than $100,000, using a QCD will not satisfy your entire RMD.

You must be at least 70.5 years old to use the QCD feature of an IRA.

Create a Donor Advised Fund:

Pros

Setting up a donor advised fund is an easy, efficient way to give.

You can gift (transfer) low basis securities directly into your donor advised fund and receive 2 tax benefits: you receive a tax deduction for the market value while also getting rid of any capital gains attached to that security, thus making this strategy extremely tax efficient.

Cons

Donor advised funds have the greatest impact when you itemize on your tax return, rather than taking the standard deduction. In an ideal world, you want to “bunch” your donor advised fund contributions into a single year so you can maximize your itemized deductions.

As with any charitable giving, contributions to your donor advised fund are irreversible.

Donate Low Basis Securities directly to Charity:

Pros

Cons

Elias John Crist, Associate Relationship Manager