Commentary

As part of our fiduciary approach to considering your best interests, we provide regular updates and news items about our firm, as well as information and commentary we deem to be relevant and worth your time. We invite you to contact us about any of these articles and releases. We’re only too happy to answer your questions.

The Pros and Cons of the PE Secondaries Market for Advisory Clients

Wealth Solutions Report

With endowments like Yale and Harvard considering selling some or all of their private equity holdings to the secondaries market for enhanced liquidity, our Founding Principal and Managing Director Craig Robson weighed in on how advisors should be approaching PE secondaries.

Increased turnover in private equity has expanded the opportunity set, and Regent Peak continues to have strong conviction in the role that secondaries can play in an overall portfolio construct.

However, investors should fully understand what they own and why they own it. Craig notes that secondaries generally have different fee structures than public investments and typically may not be used as collateral sources for lending facilities. Advisors also need dedicated resources to diligence and monitor them—and must be prepared to educate clients on both the pros and the tradeoffs as part of a broader allocation strategy.

Read the article HERE

more'Sell in May and Go Away'? Wealth advisors say, maybe not

InvestmentNews

Each spring, the old investing adage “Sell in May and go away” starts making its rounds. But does seasonal market timing actually hold up, and is it worth the risk of stepping out of the market? Our CIO Nathan Hoyt doesn’t think so.

“If you sell in May, what do you buy that outpaces the historical 3 percent annualized returns until October? When October arrives, risk doesn’t magically disappear, even if you are disciplined enough to re-invest,” Hoyt said. “Seasonality trends are easy to spot and thus a tempting trap that investors fall into thinking they can time the market, unlike the rest of us. I wouldn’t ask my clock or my calendar to predict the future.”

Read the article HERE

moreHow Estate Plans Are Changing Under the Trump Administration

The Daily Upside

Estate planning isn’t a “set it and forget it” process – especially in times of political change. With recent tariff news signaling significant policy shifts from the new administration, potential reforms to the Tax Cuts and Jobs Act could be next in line.

In this piece our Founding Principal and Managing Director, Craig Robson, explains why advisors and clients should brace for potential changes to estate tax policy. By spotlighting tools like multigenerational education, scenario planning and tax-smart gifting, Craig encourages advisors to reassess financial plans now and take steps to help safeguard client wealth and legacy.

Read the article HERE

moreBonds, CDs, Annuities? 10 money pros on exactly what 'safe-haven' investments to consider now

MarketWatch

“While there is nothing safe about the stock market, those with long term investment horizons that buy into these types of volatile markets have historically grown their wealth, and despite the reasons for the sell-off feeling quite scary each time, the best investors consistently buy more risk assets in ugly environments.” He adds that “if tariffs truly are more seeds of inflation, 4.4% is unlikely to keep up with rising costs, even if interest rates remain the same. Using more esoteric strategies like structured notes or private investments can provide a portfolio with less volatility if not higher returns, yet the longer time frame and illiquidity of these types of investments should be considered before selection.” -Nathan Hoyt, CIO

Read the article HERE

moreAre REITs back?

InvestmentNews

Is this the end of the Magnificent 7?

InvestmentNews

What Trump's tariffs mean for markets

Reuters

With new tariffs now in effect, our CIO Nathan Hoyt weighed in on how tariffs are simply a policy tool - neither inherently good nor bad, but defined by their intended use. He also breaks down their potential economic and trade impacts:

"Tariffs could be a terrible policy mistake, leading to anti-free trade (if you like that perspective), or it could be necessary economic medicine to bring back manufacturing to the U.S. and negotiate better terms for the U.S. (if you like this one)."

Ultimately, Nathan notes that the true impact of tariffs will only be clear in hindsight - and they shouldn't impact your investment strategy. While tariffs may create short-term noise, long-term investors should stay focused on diversifying across multiple asset classes.

Read the article HERE

more5 harsh realities of investing in crypto

Business Insider

With crypto experiencing recent volatility, our Founding Principal and Managing Director Craig Robson reminds investors that strong performance in 2024 doesn’t mean digital assets won’t have a big draw down or pull back like in 2022. He emphasizes that crypto must be suitable for each investor’s risk tolerance.

“Everyone says that they can handle volatility when times are good. When things aren't good, I call it your pain threshold," Craig said. "Upside volatility is great, but the knife cuts both ways."

Read the article HERE

moreUsing tech to help clients through divorce: Show Me Your Stack

FinancialPlanning

Divorce is a challenging time, both emotionally and financially, but the right guidance can help clients navigate it more smoothly. Our Founding Principal and Managing Director Craig Robson gave Rob Burgess a look into how we leverage advice, education and financial tools to help clients find the best path forward amid divorce.

As Craig explained, we help clients outsource the financial aspects of their life so they can focus on what matters most – their families, careers and personal interests. Through strategic planning technology, we provide the clarity and stability they need to navigate difficult transitions like divorce and work toward the best possible outcome.

Read the article HERE

more

The Fed's 'preferred' measure of inflation is core PCE. Do advisors favor it as well?

Gregg Greenberg

In a recent InvestmentNews article, our Founding Principal and Managing Director Craig Robson explained how the monthly CPI index – minus the “owner’s equivalent rent” (OER) component – offers a directional snapshot of inflation and how investors can historically combat inflation with public equities.

In fact, Craig highlights that from 1945 to 2023, investors who held cash lost purchasing power by 90%, while those who invested in the U.S. stock market with dividends reinvested significantly outpaced inflation.

Read the article HERE

moreAdvisors Want In on Private Credit. Should They?

The Daily Upside

Private credit is on the rise. In this piece, Craig Robson shares that the asset class "is another tool in the toolbelt" that can offer investors diversification beyond traditional bonds or dividend-paying stocks.

While private credit presents compelling opportunities, Craig also notes that investors should stay mindful of potential risks. As more capital flows into private credit, the possibility of underwriting standards could weaken, potentially leading to credit deterioration. “Will we have a scenario where underwriters get a little lackadaisical in their diligence? I hope that won’t be the case – but hope isn’t a strategy, as we all know,” Craig said.

Read the article HERE

moreCraig's Corner - The Gambler

In January our family went to Las Vegas to watch my younger son's hockey team play in a tournament out in the desert - yes, ice hockey is becoming a national sport! For this Atlanta-based group of 17- and 18-year-old young men, it was their first trip to the city known for its entertainment value, especially the gaming industry. Watching their expressions and body language as we toured the casinos between games was worth the price of admission as it was definitely an educational experience. There were multiple mini discussions throughout the weekend between parents and their kids, which included questions such as: "Why is gambling addictive for some people?", "Why don't people stop once they have generated a profit?", "Which games have the best odds of success?", and so on. From a hockey weekend perspective, our boys experienced some difficult odds as two of their five games included a come from behind victory late in the 3rd period as well as an overtime and subsequent shoot-out victory. It was gut-wrenching for the parents! Fortunately, the team wasn't overly distracted as they went undefeated and won the tournament, returning home with the hardware they were seeking, including a team trophy and individual gold medals.

moreWickedly Flawed Investing Ideas

WealthManagement.com

The New Year often brings a wave of bold market predictions and seemingly "can’t-miss" investment ideas. But as our CIO Nathan Hoyt explores in his latest piece for WealthManagement.com many of these trends – whether it’s overconfidence in volatile assets or the sustainability of an 8% withdrawal rate – can be more illusion than reality.

Drawing inspiration from The Wizard of Oz and Wicked, Nathan highlights how investors, much like Dorothy and her companions, must look beyond surface-level narratives and challenge assumptions before making financial decisions. At Regent Peak Wealth Advisors, we believe in disciplined, long-term investing tailored to individual goals – not chasing trends that may lead to an unexpected financial twister.

Read the article HERE

moreIt's Trump 2.0 What Financial Advisors Are Telling Clients to Do Now

Barron's Advisor Planning Strategies - The Big Q

Certain clients have some concerns, and others are super supportive. Most clients are somewhat agnostic to it all. And that’s because we make sure our clients understand that capital markets are generally agnostic to whoever’s in the White House. I like to say that a president gets too much credit when things go well from a capital-markets perspective and too much blame when things don’t go well. We make sure clients understand that their financial plan is their bedrock, and investments are a means to fund those goals. So long as we keep them centered on that, our clients are generally pretty good in terms of managing the day-to-day noise. -Craig Robson, Founding Partner and Managing Director

Read the article HERE

moreCharitable contributions: How to get a tax deduction for your donations

Bankrate

With tax season underway, now is the time for investors to assess their 2024 charitable contributions and to plan ahead for 2025 giving to maximize tax benefits.

Consider strategic giving, including how individuals can:

- Evaluate whether the standard deduction or itemizing contributions provides the greatest tax benefit

- Consolidate donations into a single tax year to surpass the itemization threshold

- Leverage donor-advised funds (DAFs) for immediate tax benefits while maintaining flexibility in charitable giving.

Read the article HERE

moreU.S. Inflation Rates Over Time and the Forecast for 2025

U.S. News & World Report

With the recent release of December’s CPI data, our AWA Nick Fazio provided insights into inflation trends, why both annual and month-over-month figures matter for a fuller picture, as well as how investors should account for inflation in their financial plans:

"As life expectancies continue to increase, you’re going to want to have a financial plan that anticipates the impact of inflation over multiple decades,” said Nick. “It can feel odd to plan on spending amounts that are significantly higher than what you spend today, but it’s imperative to plan on future increases in price levels to be able to live the great life you envision down the road.”

Read the article HERE

moreWealth managers planning to add to ranks in 2025

InvestmentNews

We believe in a smart growth strategy, which allows us to build our team in a manner that aligns with the anticipated needs of the firm, prevents reaching capacity and protects the well-being of our employees.

In line with this strategy, our COO Emily Raymond pointed Gregg Greenberg toward our 2025 expansion plans, where we’re looking to create a business development role and a “hybrid” position that supports our client service associates, associate wealth advisors and planning team.

“You can’t have one without the other to produce quality, efficient, top-notch service to our clients,” Emily noted.

Read the article HERE

more3 Ways to Get Into Crypto If You Haven't Yet

BusinessInsider

"Make sure you know what you own and why you own it."

In a recent conversation our Founding Principal and Managing Director Craig Robson reminds investors of this principle when evaluating new investment opportunities, especially as bitcoin and other cryptocurrencies continue to rise in popularity.

For investors who are looking to diversify with digital assets and determine crypto is a suitable addition to their portfolio, small allocations to crypto ETFs, for example, can help manage risk while gaining exposure to this asset class.

Read the article HERE

moreCharting the Ascent - CIO Insights, Issue 1

As we launch into the first edition of our latest newsletter, “Charting the Ascent,” I’m going to share some knowledge with you, grammar police be damned: Once you know it, you can’t un-know it. The meaning of the phrase “begging the question” is a controversial topic, and I’m one of many who will silently judge you when you use it incorrectly. Miriam Webster has a great article “Beg the Question: It’s not begging at all” (Link below) on the idea.

Most will recognize the phrase to mean “prompting the question” on the heels of a statement or supposition that inspires the need for more information. However, the original phrase comes from a 16th century translation of Aristotle’s “petitio principii,” pointing out a logical fallacy, which is better known as “assuming the conclusion.”

Aristotle’s translated version of “begging the question” is the idea that your argument or thesis is correct on the assumption that the thing you are trying to prove is already correct. Most uses of this version are found in philosophy—a example is “black cats are bad luck and therefore would make a bad pet,” begging the question that black cats are unlucky. So-called mainstream financial “gurus” are constantly guilty of this fallacy, because the future is so uncertain.

more"Advisors contemplate crypto beyond Bitcoin in 2025"

InvestmentNews

With Bitcoin’s recent performance surge and a strong year for digital assets overall, Craig outlined why advisors and investors alike may be more amenable to digital assets in 2025:

- Congress continues to embrace digital assets, creating a more favorable regulatory environment

- Volatile digital assets like Bitcoin and Ethereum offer tax-loss harvesting opportunities for those with direct ownership

- Cold storage solutions reduce the risk of predators accessing and stealing crypto assets

- The use cases for digital assets, such as blockchain-powered internet and digital currency, continue to evolve

Read the article HERE

more"Active ETFs Gain Appeal Across Wealth Management"

ETF.com

Active management is gaining traction within the ETF space, with active ETFs expected to surpass $4 trillion by 2030. Our CIO Nathan Hoyt weighed in on the rising appeal of active ETFs, their benefits for investors and the importance of understanding the underlying investments of these funds.

Read the article HERE

more"Sophisticated Internet Scams Targeting Elderly Clients Are Rampant"

WealthManagement.com

Unfortunately, our clients and their loved ones are not immune to the sophisticated fraud schemes that are so prevalent today, making these conversations a constant reality. Fraud does not discriminate; it targets everyone, regardless of background or financial status. We have witnessed a range of scams, from criminals impersonating government officials or local authorities to fraudulent Bitcoin investment managers, some with heartbreaking results. It is imperative to be proactive about these discussions before it’s too late by taking the appropriate actions.

Read the article HERE

more"Forget mega-money deals, here's how smaller RIAs are growing"

Citywire RIA

Since Regent Peak Wealth Advisors became independent in 2019, we've strategically grown by refining how we serve and connect with our clients. In this article, Craig reflects on how client relocations and connections with centers of influence have fueled our national growth. We've developed innovative services - like consulting on illiquid assets and preparing our business-owner clients for tax-efficient sales - allowing us to go beyond traditional wealth management offerings.

Read the article HERE

more"Listings down and election over, advisors see opportunity in VC funds"

InvestmentNews

As IPOs and private company exits are increasing, our Founding Principal and Managing Director Craig Robson recently spoke with Gregg Greenberg on why we view venture capital as a favorable asset class heading into 2025.

The Regent Peak Wealth Advisors investment committee recommends venture capital as a subset of our private investment allocation, which also includes private equity, digital assets, private credit, commodities, and private real estate, as is deemed suitable for your portfolio.

Read the article HERE

more"Hot Minute" with Craig Robson

Real Assets Adviser

Our Founding Principal and Managing Director joined Ed O’Farrell for a “Hot Minute” to discuss how offering clients interesting alternative investment opportunities can foster a sense of excitement and engagement, our founding story and more on Craig’s background, including his alma mater, first job and the book that’s shaped his investing philosophy.

Check out the podcast HERE

moreCraig's Corner - Live Like You Were Dying

It was an Autumn Friday evening, approximately one year ago, that I received a text message from a good friend stating he needed to speak with me. I was in Tampa attending my younger son's hockey tournament and told him I would call him within an hour. I suspected something was wrong, yet I kept a positive mindset prior to our conversation. My suspicions were unfortunately correct, as he later told me he was diagnosed with stage 4 cancer and the prognosis was not good – in May of this year he passed away to God’s Kingdom at the age of 63. My friend lived a healthy lifestyle, he had a passion for life, he was a successful entrepreneur, and was a professional mentor who helped encourage me to start my own firm. He taught me to take both professional and personal risks, to live my life to the fullest - acknowledging that is a personal decision for each of us. He will be missed by so many, including yours truly.

Excluding that “stopped me in my tracks” conversation last October, I look forward to the fall season as historically the markets perform best during this period. Since 1950, the S&P 500 has averaged over 4% in the final quarter and is up 80% of the time [1]. In a previous Craig's Corner, I have provided various catalysts which may be direct contributors to these positive results, yet please recall these are not guaranteed returns, (otherwise the proverbial Financial Santa Clause would be coming early every year), so be balanced and consistent in your investing timeframes.

more"Bitcoin surge has advisors once again answering questions"

InvestmentNews

Bitcoin’s recent surge has renewed investors' interest in cryptocurrency. However, as our CIO Nathan Hoyt shared with InvestmentNews, this performance likely stems from the U.S. government’s continued stance on cutting interest rates amid rising debt and deficits, fueling inflation and currency devaluation.

Read the article HERE

more"Play Defense: Simple Advice for Clients to Combat Fraud"

Wealth Solutions Report

The threat of financial fraud is becoming a bigger threat as we enter an ever-evolving digital world. That leaves a looming question: how can advisors help combat this? In his piece, Elias offers fraud prevention strategies such as complex passwords, enabling dual-factor authentication, freezing credit and more. These are proactive measures that advisors can provide to their clients annually to reduce the risk of cybercriminal activity.

Read the article HERE

more

"Wealth managers discuss their hiring needs"

InvestmentNews

Craig Robson, Founding Principal and Managing Director at Regent Peak Wealth Advisors, notes that while this Friday’s September jobs report won’t specifically illuminate the wealth management industry, the financial advisory business continues to add professionals across various roles.

“Each firm’s respective growth and resource strategy will drive these new employment opportunities,” said Robson. “Within Regent Peak Wealth Advisors, we maintain a smart growth strategy which translates to hiring new talent before we are capacity constrained. Our next hires will be within the business development, advisory, or client services roles as these will allow us to continue being ‘laser-focused’ on growth initiatives.”

Read the article HERE

more"How AI is Changing Financial Advisors' Jobs"

Financial Planning

The promise of AI is to help advisors improve efficiency and automate routine tasks, but what does that mean for advisors?

In this piece Craig delves in to his thoughts: AI taking his job any time soon. He believes that the value of the human element cannot be replaced. Clients consistently seek advisors who offer competencies, knowledge, experience, personality, relational connections, willingness to serve and strong ethics–qualities that AI cannot fully replicate. While AI tools can be valuable in an advisor’s toolbox, the human connection remains indispensable.

Read the article HERE

more"September is historically a scary month for stocks. Why not "market time" it?"

InvestmentNews

Nathan Hoyt, Chief Investment Officer at Regent Peak Wealth Advisors, does not look to seasonality as a core investment thesis because he is no market timer. “In essence, market timing is based on the hope that you are smarter than the market or that you are convinced the future will behave like the past. I prefer an investment strategy that I can stick to regardless of the calendar, rather than one that depends on the calendar,” said Hoyt.

Read the article HERE

more"Rate cuts loom, but this savings account still offers 6.25% - plus 9 more of the highest-APY savings accounts in September 2024"

MarketWatch

Newer banks, who are trying to build up a strong base of account holders, are willing to pay higher rates to entice them to move their accounts from other lower paying competitors,” says Manning. However, risk of default in these banks could be slightly higher, so with that in mind it is advisable to keep account balances at or below your FDIC protection limits.

Read the article HERE

more"Should Investors Brace for More Volatility? Here's Where the Stock Market Could Be Headed"

Money Magazine

The market sell-off in early August was a stark reminder that pullbacks are not uncommon. Our Founding Principal and Managing Director, Craig Robson, CFP®, CIMA®, CDFA® believes that instead of making rash moves, investors should use those moments to reevaluate the risks in their portfolio and take stock of their liquidity needs to better prepare for future volatility.

Read the article HERE

more

"Stock Market Today: Dow, S&P 500 and Nasdaq close higher Friday, score best week since November"

MarketWatch

This week we have seen a notable rebound in U.S. stocks, with the Dow, S&P 500, and Nasdaq posting their best gains since November. While this uptick is promising, our Chief Investment Officer, Nathan Hoyt, CFP®, emphasizes the importance of staying vigilant.

At Regent Peak Wealth Advisors, we continue to navigate these dynamics with a balanced approach, focusing on long-term strategies amid short-term fluctuations. We remain committed to guiding our clients through these evolving market conditions with informed insights and strategic planning.

Read the article HERE

more"How Advisors Serving Business Owners Can Drive Deeper Client Relationships"

Wealth Solutions Report

Many advisors work with clients who own businesses, but not all are equipped to truly serve this niche. At Regent Peak Wealth Advisors, we understand that guiding business owners through their financial journey requires a deep understanding of their unique challenges.

Our Founding Principal and Managing Director, Craig Robson, CFP®, CIMA®, CDFA®, offers a distinct perspective as both an advisor and a business owner. This dual experience allows him to provide tailored advice, become an integral part of his clients' trusted advisory circles, and enhance the overall value and experience of their businesses.

To learn more about how Craig has shaped Regent Peak to support business owners, check out the article below.

Read the article HERE

more"More advisors offer advice for keeping cool in a market storm"

Investment News

August 5, 2024 proved to be a hectic day for financial advisors and clients due to the market sell-off.

However, our founding principal and managing director, Craig-Robson, CFP®, CIMA®, CDFA®, shared his most effective strategy for calming anxious clients: reminding them that we designed their financial plans and corresponding allocations to account for periods of downside volatility. Craig noted that “while this isn’t enjoyable, it is expected periodically,” and emphasized that it is best to avoid making significant changes to asset allocation amid market volatility.

Read the article HERE

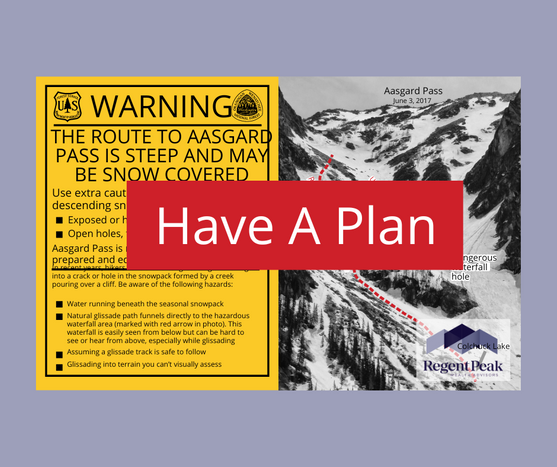

moreCraig's Corner - What Could Possibly Go Wrong

In previously coaching my son's ice hockey teams, after drawing up a new play and visually explaining it to the players, I would ask if they had any questions before we installed it into our practice plan. Once any remaining questions were answered, and before they set out to go practice it live, I would finish by asking the kids, "What could possibly go wrong?" This latter question was by design, partially to provide some levity yet also to get them thinking ahead, because if mistakes were made, I wanted them to consider in advance about how they would adjust in the moment, as hockey is a game of speed predicated on time and space.

Earlier this summer a close friend of mine and I decided to hike a super challenging mountain in the state of Washington. For me personally, this hike would be in my top five in the difficulty category, and I was excited to check it off my list. On our two- and half-hour drive from Seattle to The Enchantments, we discussed the severity of the upcoming hike and I joked with my friend by saying, "What could possibly go wrong?" Little did we know that later in the afternoon we would find out! Our hike up the mountain was uneventful, yet longer than we had estimated as it was unseasonably hot that day and the scree covering the final 2,000 feet of elevation (Aasgard Pass) made our hike much slower than we had planned. We hit the summit by 4:00 PM (our initial estimate was 1:00 PM), and acknowledging we were behind schedule, we did not stay long admiring the views. With a big afternoon ahead of us heading down the mountain, we started our descent as we wanted to get to our car before nightfall set in. Approximately 1/3rd of the way down (we were about 5,500 feet from the basecamp/parking lot) we came upon two young ladies, one of which was lying on the ground and in obvious pain. Her friend confirmed she was having severe leg cramps and we suspected she was extremely dehydrated. After diagnosing the situation (they had minimal water, food, layers of clothing, and the one hiker was barely speaking and could not walk) it became obvious that we would have to help them get off the mountain or they would be stranded overnight (dehydration, starvation, and bears were all scenarios they would possibly encounter). Pulling from our previous experiences, as well as the resources we had packed, we devised a few different plans to get her and her friend off the mountain. Ultimately, we made contact with the local park rangers via our Garmin SOS device (if you are a hiker and don’t have one I strongly encourage you to purchase it). and Approximately 3 hours later park rangers arrived via a helicopter to remove them in a stretcher and helicopter them off the mountain directly to the local hospital. Once the helicopter departed, reality sunk in - we were left alone and still had to climb 5,500 feet down the mountain in the dark using headlamps as our only light source. We made it back to Seattle twelve hours later than expected, grateful for both a hot shower and shelter.

moreNew Heights | Mid-Year 2024

Here we are, at the mid point of 2024! At this juncture, your Regent Peak team reflects on significant internal processes and expansions of our partnerships to enhance our business, allowing us to maintain our steadfast client-centric approach. We continue to hear from you on what's important, and while that can differ across the clients we serve, one thing remains at its core: our ability to engage with you in personalized ways across the customized service offering we provide our families.

We experienced a change in many of our tech partners in recent months, which allowed us to shop the market and find the most suitable option for us to perform at a peak level. While you, the families we serve, are not directly impacted by such changes, it internally allows our team to access enhanced platforms, gaining efficiencies so we can keep the quality of our client service at the forefront.

In year five, we continue to be proud of our successes acknowledging there's always room for growth. We consistently look for ways to be better, expand our way of thinking, all while having fun and keeping an open mind to the creative solutions that are evolving. Read below for details on our latest activities and remember that we have your best interest in mind.

more"Serena Williams once tried to deposit a $1 million check at her bank’s drive-through. Here’s why you can’t do that."

MarketWatch

When it comes to depositing a windfall of cash, it’s often more complicated than simply going to the bank..

Our Chief Financial Officer and wealth advisor, Kevin Manning, CFP®, says that policies regarding how to handle large sums vary from institution to institution, but it is best to contact your bank ahead of the deposit. This is not only best for the individual, but will also help in building a relationship with your bank.

Read more on Kevin’s thoughts regarding depositing large sums of money in a recent MarketWatch article.

Read the article HERE

more"Forget the returns. Advisors look to private markets for diversification"

Financial Planning

A Blackstone study found that 90% of surveyed advisors had helped their clients into private markets, with 70% of the respondents saying their clients had allocations of 5% or more.

Our Founding Principal and Managing Director, Craig Robson, CFP®, CIMA®, CDFA®, spoke with Dan Shaw about this survey and why Regent Peak allocates 10-30% of their client portfolios to private markets for diversification and downside protection, rather than seeking high returns.

Read the recent Financial Planning article for Craig’s full take on the importance of diversification and the careful selection of private market investments for long-term stability.

more"How many stocks should you own?"

Bankrate

In Mallika Mitra's Bankrate article, our associate wealth advisor, Nick Fazio, CFA, CPA, emphasized the importance of avoiding overly concentrated portfolios to mitigate volatility and enhance long-term investment stability.

When discussing the volume of stocks an investor should own, he focused on the value of diversification sharing: “If you had 30 stocks and they happen to be in one specific sector, you’d still be way less diversified than if you only had 10 stocks but they were across a bunch of sectors. You want to make sure that in the effort to diversify, you are picking stocks that shouldn’t generally be trading alongside each other.”

Read on for Nick’s thoughts and strategies when it comes to buying stocks.

more"Advisors name the most overlooked financial issues during divorce proceedings"

Investment News

In an InvestmentNews article, our Founding Principal and Managing Director, Craig Robson, CFP®, CIMA®, CDFA® shares invaluable insights on the often-overlooked tax implications financial advisors must consider when assisting couples through a divorce.

From retirement plans and Qualified Domestic Relations Orders (QDRO) to the tax treatment of child and spousal support, Craig emphasizes the importance of understanding these critical components to avoid unnecessary penalties and liabilities down the road.

Read the full article for Craig’s expert advice on navigating the complexities of divorce-related finances to ensure the best outcome for all parties involved.

Read the article HERE

more"Three Common Financial Blind Spots and How to Navigate Them"

Kiplinger

With 70% of families losing their wealth by the next generation and 90% by the third, it is crucial for advisors to work with clients on preserving financial stability. In a piece for Kiplinger, our Chief Investment Officer Nathan Hoyt, CFP® highlights three key blind spots that investors need to address to establish and maintain multigenerational wealth:

“While cautionary tales of lavish and wasteful spending certainly exist, the reality is that wealth erosion often stems from the unexpected. To preserve their financial stability, investors should be focused on several key considerations: managing tax inefficiency, bridging insurance gaps and envisioning multiple market outcomes,” notes Hoyt.

Learn more about how each of these strategies can be leveraged to protect and preserve investors' wealth.

Read the article HERE

more"Private market investments are not a crowded trade despite all the attention"

Investment News

Founding Principal and Managing Director, Craig Robson, CFP®, CIMA®, CDFA® sat down with Gregg Greenberg to discuss the strategic advantages of incorporating private markets into investment portfolios.

He shared, “In our experience, having a multi-asset class approach, which includes private investments, optimizes returns and compresses volatility over the long-term.”

Watch the full interview on InvestmentNews to learn more on how Regent Peak Wealth Advisors is leveraging private market investments to enhance portfolio performance.

more"Juggling work-life balance during vacation season"

Investment News

With summer just around the corner, many of us are gearing up to take time off to relax, travel, and spend quality moments with family and friends. In an InvestmentNews article, our Founding Principal and Managing Director, Craig Robson, CFP®, CIMA®, CDFA® shares how we navigate work-life balance during vacation season at Regent Peak.

With an unlimited PTO policy and flexible work arrangements, we take a collaborative approach to ensure our employees can take well deserved time off. This strategy allows us to maintain smooth operations while an employee is on PTO, as our team members work together to cover responsibilities and maintain continuity at all times.

Read the article HERE

moreCraig's Corner - Getting Started

Earlier this year our older son was accepted into a 7-month internship with a scuba diving company in Key Largo, FL. Upon completion of the program, graduates will have obtained multiple diving accreditations/licenses which will subsequently provide them an opportunity to teach anywhere in the world - I asked if they were accepting applications from 54-year-olds! In addition, graduates will have secured navigational licenses so they may also drive larger vessels in the waters. The learning program runs 6 days a week starting at 6:00 AM and many days into the late evenings. They receive minimal compensation yet obtain numerous skills which are immediately transferable into the workforce upon completion. He and our family reviewed the benefits and costs of the program, and his only real hesitation before accepting the position was that he wasn't entirely sure if this was the career path he wanted to pursue professionally as an adult. I reminded him that his father studied engineering in college, started his professional career with an IT consulting firm, and now is a business owner who leads a wealth advisory firm. I told him it was more important to start somewhere and gain experiential skills rather than trying to figure out what you think you may want to do in your professional life. My comments must have resonated with him because in mid-April he and I flew down to Florida so I could drop him off to meet his fellow interns and employer as he was starting his internship.

more"Do Warren Buffett’s words still carry weight on Wall Street?"

Investment News

At Regent Peak, we follow a rules and process-based approach, and our investment portfolios are tailored to each client's unique financial situation and long-term objectives. And while we appreciate Warren Buffett and other investing luminaries, we're not relying on their insights to inform our investing decisions.

In a recent InvestmentNews article, our CIO Nathan Hoyt, CFP® discussed how our investment decisions are not influenced by the whims of financial gurus or influencers, no matter how memorable their quotes may be.

Read the article HERE

moreRegent Peak Wealth Advisors Doubles Assets Under Management Five Years After Becoming Independent RIA

BusinessWire

Tomorrow, Regent Peak Wealth Advisors celebrates our five year anniversary. To honor this, we are excited to highlight key milestones that we have achieved since 2019, as well as the strategic expansion of our investment platform to better meet our clients' unique wealth objectives.

Our founding principal and managing director Craig Robson, CFP®, CIMA®, CDFA® shared: “The talented, hard-working team that we’ve built at Regent Peak enjoys nothing more than solving complex challenges for our clients, helping them achieve their life goals with truly objective advice. I couldn’t be prouder of the culture and firm that we’ve built.”

Read the article HERE

more"Preserving Multi-Generational Wealth"

Wealth Solutions Report

When wealth is passed on to the next generation, 70% of high-net-worth families experience a significant loss of assets. To address this issue, our founding principal and managing director, Craig Robson, CFP®, CIMA®, CDFA®, details the importance of interfamilial dialogue and clear communication in order to preserve wealth across generations in an article for Wealth Solutions Report.

Craig highlights how a family's trusted family advisor can play a pivotal role by initiating and guiding conversations with the younger generation about estate management, outlining financial responsibilities to heirs, and involving the family's network of experts for more comprehensive estate discussions.

Read the article HERE

more"What’s in an acronym? Advisors name their favorite designations"

Investment News

In our work with clients, it's important that we're truly experts in the fields of financial planning, investment management and beyond. That's why our founding principal and managing director Craig Robson, CFP®, CIMA®, CDFA® says the CFP designation is the most beneficial for an advisor to have as it covers a comprehensive range of consulting topics within a client’s overall financial plan design. From there, advisors can get more tactical and specialized in their focus areas for clients.

Read the article HERE

more"Advisors increasing allocations as small-caps rally"

InvestmentNews

As small-cap stocks gain momentum in client portfolios, our chief investment officer Nathan Hoyt, CFP® explains to Gregg Greenberg the market conditions that drive the growth in value of these stocks.

Nathan foresees a decrease in interest rates during the latter half of the year, noting that historically, such a falling rate environment has been beneficial for both small-cap growth and value companies.

Read the article HERE

more"Regent Peak’s Craig Robson on the Contrarian Strategy that Led to Rapid Organic Growth"

RIA Edge Podcast / WealthManagement.com

At Regent Peak Wealth Advisors, we focus on all aspects of our clients lives to create smart solutions that go beyond investment management. As an independent firm, we have flexibility to tailor our services to better meet the evolving needs of the multi-generational families, business owners, entrepreneurs, corporate executives and wealth creators that we serve.

Our Founding Principal and Managing Director Craig Robson, CFP®, CIMA®, CDFA® spoke with David Armstrong on the RIA Edge (Part of Wealth Management EDGE) podcast to discuss the successful strategies that have fueled our growth over the last five years. He delves into our strong focus on client satisfaction, how and why we involve all family members in the financial decision-making process, and the industry relationships we leverage to provide the best possible service.

more"Niche of the Week: Entrepreneurs and career changers"

Citywire RIA

At Regent Peak Wealth Advisors, we are dedicated to serving corporate executives and business owners as they navigate career transitions and challenges, as well as understanding the financial implications involved.

Our founder and managing director Craig Robson, CFP®, CIMA®, CDFA® spoke with Reagan Darrah about our approach to supporting clients in achieving their professional ambitions while modeling their financial plans to reflect these aspirations.

Read the article HERE

more"Nathan Hoyt Takes on the 4% Rule"

ETF.com

Our chief investment officer, Nathan Hoyt, CFP®, is dedicated to building simple yet integrated strategies to help individuals and families achieve their financial objectives, particularly during times of transition. A strong advocate for taking a tailored approach to advice, he offered insight on the 4% withdrawal rate in retirement with Jeff Benjamin of ETF.com.

Read the article HERE

more"Three Keys To Multigenerational Asset Transfer"

Wealth Solutions Report

“Historically, advisors have approached multigenerational planning by preparing assets for the family. However, to achieve true success, advisors should flip their thinking and prepare the family for the assets."

Craig Robson, CFP®, CIMA®, CDFA®, Founding Principal and Managing Director of Regent Peak Wealth Advisors, highlights three tactics advisors can implement to prepare families for wealth transfers while maintaining their peace of mind.

Read the article HERE

more"Advisors Lean Into Alternative Investments"

ETF.com

With public equities reaching expensive valuations, our CIO Nathan Hoyt, CFP® outlines why now could be an ideal time to allocate to private markets.

Read the article HERE

more"How to Amend a Tax Return: How and When to File Form 1040-X"

Buy Side from WSJ

Ahead of tax season Nick Fazio, CFA, CPA, Associate Wealth Advisor at Regent Peak Wealth Advisors, advises clients to diligently review their tax documents to avoid filing an amended return. In a recent discussion with Aly J. Yale, Nick explains that "mistakes can come from many sources, but often arise from documents that either arrive late or the taxpayer forgets to expect."

Read the article HERE

moreProviding Context for Your Financial Life

Nick Fazio, CFA, CPA

Last weekend, I came down to the living room to join my wife, who had already started watching The Proposal. Having joined about an hour into the movie, I naturally had some questions.

Why is Sandra Bullock joining Ryan Reynolds’ family in Alaska?

Why are they faking being engaged?

What’s the beef between Ryan Reynolds and his dad?

Obviously, my wife was thrilled.

Context is important. As rom-coms always allude to, people do crazy things when they’re in love. And while flying to Alaska to fake an engagement to your assistant in front of his family in order to avoid deportation back to Canada might not be the optimal solution, context at least makes the decision understandable.

In wealth management, your financial plan provides context, and this context is the guiding principle upon which all subsequent decisions should be made. Context is critical because financial planning is often less about absolutes and more about trade-offs between competing pros and cons.

Let’s use investments, for example. How exactly should someone invest? Should you put all of your money in stocks, or maybe the traditional 60/40 portfolio? Should you consider investing in private markets? What about the investments that financial news is fixated on, like cryptocurrency or NVIDIA? The answer is going to depend on several factors related to the client because none of these strategies is always the right answer.

more"New Year's Resolutions Wealth Advisors Wish Clients Would Make"

BARRON'S

As we settle into the new year, our founding principal and managing director Craig Robson, CFP®, CIMA®, CDFA® sits down with Steve Garmhausen to discuss how he recommends advisors brainstorm resolutions and financial goals with their clients.

At Regent Peak Wealth Advisors, we factor in our clients’ aspirations, like building their dream home or starting a business, into their overarching plan and help them evaluate the steps necessary to achieve them.

Read the article HERE

moreCraig's Corner - Open Your Windows

As a kid growing up one of my favorite TV shows to watch was Wide World of Sports. Most of us who grew up watching the show recall the opening monologue, “Spanning the globe to bring you the constant variety of sport/The thrill of victory and the agony of defeat/The human drama of athletic competition/This is ABC’s Wide World of Sports." As I look back, I now realize how much of an impact this show had on me as it introduced me to so many different sports which I had not seen or experienced previously such as martial arts, speed skating, downhill slalom skiing, cliff diving, surfing, sumo wrestling and so many others. This provided the catalyst for me to try different sports rather than just the traditional ones I had played growing up. Over time I came to realize these new sports provided many complementary skills and trained new muscle groups which ironically made me better in the athletic programs I enjoyed playing the most.

At the end of October 2023, investors felt like they were also experiencing the agony of defeat as they had just witnessed three consecutive months of negative returns (Aug -1.77%, Sept -4.87%, Oct -2.2%) [1], yet by late December the capital markets were in a more festive mood and returned 8.92% in November and another 5.23% through December 27, 2023 [2]. As a self-described "stats geek", these positive returns at year-end were not very surprising to me as historically the fourth quarter has been the best quarter for equities over the last one hundred years [3]. To add to the positive momentum, in the year leading up to the last twenty presidential elections since 1944, the S&P 500 has been positive 18 of 20 times for an average of 9% [4]. What is it about the last three months of the year, as well as presidential election years, which provides such capital markets euphoria? From a less technical point of view, a few catalysts typically include:

moreShould I Sell My Home?

Nick Fazio, CFA, CPA

With fall fully in swing and football tailgates quickly making way for holiday parties, chances are, the number one conversation piece at your next social gathering: the housing market. Call it a sign of the times, but it appears that America’s favorite current form of window shopping – and source of neighborhood gossip – is Zillow ®.

Home prices have shot through the roof since the summer of 2020 [1], and despite mortgage rates now sitting at the highest levels they’ve been since 2000 [2], prices have barely budged. While much has been written about difficulties for first time homebuyers in this market environment, existing homeowners also face a challenging set of concerns:

- Should I lock in the gains on my house before the market turns?

- Should I take this opportunity to downsize?

- Should I put off moving? I can’t give up my 3% mortgage.

These are valid concerns, and attempting to time the real estate market can be just as perilous as timing the financial markets. However, in what may be unexpected advice from a wealth management firm, it’s important to not reach conclusions about your home solely from an investment lens. Your house may happen to be one of your largest investments, but it’s also your home. It’s the setting for many of life’s greatest moments. It’s where your daughter learned to ride a bike. It’s where the backyard hosts the family’s annual Thanksgiving game of two-hand-touch. It’s where your dog eagerly awaits your arrival home from work each day. Call it memories or nostalgia, but these things hold value – even if they have not been incorporated into your Zestimate® .

moreMultigenerational Wealth Management

Here’s a shocking statistic: Approximately 70% of transferred wealth is lost by the second generation and 90% by the third generation [1].

Some of the reasons why these current trends exist include: 1) the rising generation doesn’t currently have an existing relationship with an advisory firm, 2) the wealth management industry has primarily focused on preparing the assets for the family and neglected to prepare the family for the assets, and 3) a breakdown in communication between family members.

Conversations within families about managing wealth can be complicated and nuanced. Think about how many different personalities, capabilities, interests, motivations that can exist within an immediate family unit, let alone in the multi-generational structure.

Just as parents might recognize they need to nurture their children differently because of their personalities, perspectives and tendencies, family leaders may need to approach conversations about long-term family wealth management differently.

At Regent Peak Wealth Advisors, we believe that there is a short-list of considerations that should be made about how family leaders would like to establish as guidelines for how the family manages wealth over time, and then there are also strategies to employ for communicating those guidelines to different members of a family.

moreAsset Location Should Go Hand in Hand with Asset Allocation

Last year Regent Peak Wealth Advisors shared a video from our Founding Principal and Managing Director, Craig Robson, CFP®, CIMA®, CDFA® that explained the difference between asset location and asset allocation. This multifaceted approach allows for tax efficiencies and diversification.

Asset Location: allows for strategic tax optimization by placing different types of investments in the most tax-efficient accounts (e.g., taxable, tax-deferred, or tax-free) within your portfolio.

Asset Allocation: involves a broader investment strategy by determining a mix of various asset classes within your portfolio (e.g., stocks, bonds, real estate, alternative investments, and cash, amongst other specialty funds). The idea here is to balance risk and reward.

As with the creation and ongoing management of anyone’s portfolio, it’s important to engage your advisory team to discuss your financial goals and assess your risk tolerance. Pairing those together to ensure your timeline to achieve your goals aligns with your objectives, and your portfolio paints a picture of your path to get there. It’s not a set and forget, its ongoing assessment and reevaluation.

Contact Regent Peak today to discuss whether your assets are strategically located as well as allocated. By implementing both, you can unlock greater potential of your wealth management strategy and work toward achieving your financial goals with confidence. We are your co-pilot. We make it happen.

moreTechnology in Wealth Management

Nick Fazio, CFA, CPA

I recently re-watched Apollo 13, the classic movie about the ill-fated 1970 mission to the moon and the teamwork required by Mission Control to bring the crew safely back to Earth. In one scene, Tom Hanks’s character needs Houston to verify a calculation because the command module’s computer has stopped working. To ensure accuracy, the entire front row of mission controllers re-calculates the equation with the appropriate technology of the day – slide rules.

Flash forward to today, NASA conducts missions with technology that is leaps and bounds ahead of the tools used in the Apollo missions. For reference, the Apple Watch 6 has one million times the processing power of the computer used in the Apollo command module [1]. NASA using more advanced technology does not make space exploration any less important. Rather, it allows astronauts to focus more of their time on the high-value items – the scientific experiments and discoveries performed in space – while allowing technology to take more of a lead on the operational aspects of spaceflight.

While nowhere near as exhilarating as rocket launches and space exploration, the wealth management industry has also undergone tremendous technological improvements over the past several decades. Following last year’s introduction of ChatGPT, much has been written about artificial intelligence and the impending “doom” it will cause for many industries, wealth management included. It remains to be seen what the future holds, but we continue to view technology as an indispensable tool, not the entire solution.

moreCraig's Corner - An Inflection Point

To escape the summer heat index in Atlanta, I typically schedule time with friends to embark on some form of outdoor excursion, which historically has included scuba diving, deep water fishing in Alaska, and destination hikes. Last month I flew to Calgary to join some friends to hike Mt. Temple in Lake Louise, Banff National Park. Mount Temple is a prominent triangular-shaped peak capped with ice and snow that towers above the village of Lake Louise. At 11,636', Temple is the highest peak in the Banff Region, but is also one of the highest peaks in the Canadian Rockies. For those of you who are looking for an adventurous and challenging hike, as well as some time outdoors in the wilderness, I encourage you to add this one to your bucket list.

The summer's equity index returns may also be described as adventurous and challenging. With the S&P 500, Dow 30 and Nasdaq 100 down 1.63%, 2.04% and 1.48% respectively [1], and treasury yields at their highest levels since the 2008 global financial crisis [2], perhaps the markets were taking a pause from what so far has been an excellent year for equities.

Not to be outdone, the August employment report released by the Bureau of Labor Statistics (BLS) was also concerning as the number of unemployed persons increased by 514,000 to 6.4 million [3]. In addition, the BLS report also cumulatively revised downward by 355,000 the YTD jobs created in both the private sector and government [4]. This was the 7th consecutive month of negative revisions, the only other timeframe with a negative revisions streak this long since revisions data has been tracked was in 20084. With jobs creation decelerating, will central banks deliver a “soft landing” later this year or in early 2024, or will we embark on a more definitive economic recession like the one we experienced starting in the back half of 2008?

moreReal Estate as a Component of Your Portfolio

Nick Fazio, CFA, CPA

The housing boom of the past several years combined with inflationary fears has created a renewed interest in real estate investing. People may forget to discuss their real estate holdings with their financial advisor, usually under the belief that real estate should be viewed as separate from their investment portfolio. However, ownership in real estate is an investment just like stocks and bonds, and there are considerable planning opportunities that are unique to real estate holdings.

When viewed in the context of an overall investment portfolio, real estate can offer several key benefits:

Current income – Income has been the primary source of investment return in real estate

Capital appreciation – While secondary to income, real estate has investors also look for capital appreciation over time, and any realized price increase adds to the investor’s total return

Inflation Hedge – Real estate valuations tend to hold up well in inflationary periods relative to other asset classes

Volatility Reduction – Real estate properties are typically not traded on liquid public markets. Because of less frequent updates in valuation, many investors feel more at ease when invested in certain types of real estate where they cannot see the daily fluctuations in price like they can in the stock market.

more

Five Tips To Get Started With A Career In Wealth Management

As your younger children move through middle and high school, guidance counselors and career advisors might suggest that children with a comparative strength in math, data and computing look into careers in “finance” or “economics”. Sometimes those recommendations can feel vast and too broadly focused to understand what paths your children should take with regard to course selection as well as extra-curricular activities. One option within those categories is private wealth management.

Certainly within wealth management there is a range of specialities or types of organizations that provide wealth management services. But first, below are a few ideas for testing the waters to determine whether your child might enjoy pursuing a career within this aspect of financial advisory.

There are a number of different courses your child can try. Accounting, Banking and Finance, Computer Applications, Economics, and Probability and Statistics are the most relevant high school level courses they should try.

Get involved in an investing club to become familiar with the markets and follow financial news. An investing club is a non-threatening way to come to understand how the markets work, interplay with one another and, and some of the basic fundamentals of investing. As parents, try to share news articles from sources like CNBC, Bloomberg Business News or the Financial Times. Conversations in the club or at home relating to the long-term nature of investing and saving are very important, as is becoming familiar with the terminology or investment lexicon.

more

New Heights | Mid-Year 2023

We're halfway through the year already?! Time has flown for us as we have focused on strengthening relationships with clients and partners - an effort that we thoroughly enjoy and value. Whether you've worked with us for decades, or you are a recent member to the Regent Peak family, our commitment to you does not differ. Just as we work to establish and adhere to a plan for our clients portfolios, in tandem with tax and estate professionals, we also evaluate our own plan, the business model we set forth and the strategic initiatives that drive us forward. It's at this time of the year that we take stock in how that plan has evolved and its trajectory for the remainder of the year. As you know, any good plan requires TLC, and we're working right along side of you in this important process.

Below you'll find some exciting news from your Regent Peak team and other updates we're pleased to share with you as we wrap up our summer season.

moreTop Five Financial Management Concerns of Small Business Owners

Nick Fazio, CFA, CPA

Small business owners face a unique set of challenges due in part to the interconnected nature of their personal and professional finances. Here are five common financial management concerns that small business owners face:

1. Raising Capital

Small businesses are often capital intensive, especially in the early years of ownership. This can be a daunting time in the life of a business, and owners are often more concerned with securing any capital available than strategizing how to obtain the right capital. While we’ve all heard underdog stories of entrepreneurs taking on credit card debt to successfully launch their business, determining the optimal solution involves an analysis of the owner’s current assets, liabilities, and potential sources of financing.

2. Business Lifecycle Planning

New business owners are faced with many decisions surrounding the business.

Which legal entity do we choose to organize as?

Is our capital structure the correct mix of debt, the owner’s equity, and any outside equity?

How should I structure retirement plans and compensation for me and my employees?

more

What is a Qualified Small Business Stock?

The Qualified Small Business Stock (QSBS) Tax Exemption is one of the most impactful yet least understood tax exemptions for business owners. It comes from Section 1202 of the Internal Revenue Code, which states that any Qualified Small Business shareholder can sell their qualified stock, aka ownership in the company, and will be exempt from capital gains on that stock, up to the greater of $10 million or 10x the initial investment.

So, how do you know if your business is considered a “Qualified Small Business?” At a high level the criteria is focused on the structure, size, and purpose of the business. The business needs to be organized as a C corporation domiciled in the United States, and the company must operate in a qualifying industry. To quantify which “small” businesses can benefit, the company’s gross assets must not exceed $50 million at any time before and immediately after the issuance of the stock. Finally, at least 80% of its assets must directly support the business’s operations.

The business owner’s investment itself must also meet certain criteria to receive the preferential tax treatment. The investment must be in the form of common stock, as opposed to stock options, convertible debt, and other types of beneficial interest. The stock must have been purchased at issuance directly from the company, and the investor must have provided money, property, or service in exchange for the shares. Additionally, the investor must be a person, and the shares must be held for at least five years.

moreCraig's Corner - Keeping It Simple

This Spring our family traveled to Europe. This trip exceeded our expectations in so many ways, my personal favorite sites were the Winston Churchill Museum and the Normandy American Cemetery. Walking through both, I gained a greater appreciation for the dedication, courage, and unwavering commitment the Allied forces had in defeating the Nazis. Through all the chaos, uncertainty, confusion, and destruction, a simple mandate of victory at all costs allowed Allied leaders to achieve their stated objective.

From a capital markets perspective, 2022 may also have been described as chaotic and destructive. With a bear market (S&P 500) decline of 25% between 1/3/22 and 10/12/221, it might have been difficult to recall the benefits of investing. Yet fast forward to June 16, 2023, and we are experiencing another bull rally2 (generally defined as 20% or greater increase preceded by a 20% or greater decline) with the S&P 500 up 24% since Oct 12, 20223. Historically the average bull market lasts 1011 days and has lasted 3.5 times longer than the average bear market (286 days)4. Bull markets average total return of 114% significantly exceeds the bear market average decline of 35%5. If the goal is to increase wealth by investing in the capital markets, one must acknowledge the uncertainty and risks while staying committed to the overall objective.

moreWhy You Should Discuss Taking a Board Position with your Financial Advisor

As financial advisors, we like to explore the big picture of both your professional and personal goals. At the root of that discussion is, what are you doing in your professional life that will enable you to fund and enjoy your personal life? Interestingly, we sometimes stumble into conversations where our relationships will say in passing, “I might also seek to join a Board…” That’s when we say, “Fantastic! But let’s talk about why and how you want to do that.”

There are all kinds of reasons to seek a Board position to raise your professional profile. Some benefits include:

Broadening your knowledge base in an industry that is tangential (or even not related) to your own, but that gives you an opportunity to critically think and problem solve in a way that might help your own organization

Expansion of your professional network in ways that could introduce new advisors or mentors to your personal development or the development of your business or employer

Opportunities to provide mentorship to others outside of your organization, which can help you learn to be a better manager in your own workplace

Learning leadership skills from your peers. Great coaches frequently tell their athletes to identify what skills and strategies they fear from their most threatening opponents, and learn and copy what they do!

more

Donating to Charity

Making a donation to a favorite non-profit organization has several obvious benefits. Firstly, the satisfaction you and your family gets out of supporting an organization that gives back in your local or national community is not only satisfying, but also provides a good example for children of all ages on the importance of helping others who might be in need.

Secondly, there are financial benefits to both the recipient and you as the donor. Giving stock often results in a larger donation to the organization, as the gift is tax-deductible and there are no capital gains taxes to pay. So, if you sold the stock first and then donated the cash, you would have to pay 20% of the cash in capital gains tax (of course this only applies if the stock has appreciated in value since you bought it). For the donor, depending on the organization you donate to, and your adjusted gross income, a varying amount of your donation may be able to be deducted from your taxes.

There are options to making stock donations, such as using a Donor-Advised Fund (DAF), so it’s important to speak to an advisor who can understand your goals and help you find the solution that fits best for you. Additionally, it does take longer to coordinate a stock transfer, so you will want to plan ahead to initiate the transaction to ensure you have time to complete the transaction before the year end.

moreWhy You Should Discuss Taking a Board Position with your Financial Advisor

As financial advisors, we like to explore the big picture of both your professional and personal goals. At the root of that discussion is, what are you doing in your professional life that will enable you to fund and enjoy your personal life? Interestingly, we sometimes stumble into conversations where our relationships will say in passing, “I might also seek to join a Board…” That’s when we say, “Fantastic! But let’s talk about why and how you want to do that.”

There are all kinds of reasons to seek a Board position to raise your professional profile. Some benefits include:

Broadening your knowledge base in an industry that is tangential (or even not related) to your own, but that gives you an opportunity to critically think and problem solve in a way that might help your own organization

Expansion of your professional network in ways that could introduce new advisors or mentors to your personal development or the development of your business or employer

Opportunities to provide mentorship to others outside of your organization, which can help you learn to be a better manager in your own workplace

Learning leadership skills from your peers. Great coaches frequently tell their athletes to identify what skills and strategies they fear from their most threatening opponents, and learn and copy what they do!

more

Team is an Important Part of the Regent Peak Culture

Company culture can be hard to describe, and also hard to maintain. At Regent Peak Wealth Advisors, we believe our culture is a significant part of our value added to our relationships. We put time and effort into building our team bond and we use our core values as a foundation for how we work with one another as well as our clients.

Our core values are:

Creative Solutions

Teamwork

Trusted Partners

Mutual Respect

Open-Mindedness

Giving Back

Fun

These values are reflected in our routines, for example:

We meet frequently to discuss what’s on our plates and share our goals for the day or week ahead. It’s a time when we can share challenges we might have and ask for input from team members to see if there might be alternative ways to go about problem solving. These team huddles allow us to exercise several of our core values at once.

Several times a year we set aside a day to get involved as a team with a selected nonprofit in the Atlanta area. Typically our contributions involve donations of our time to support the organizations’ missions.

more

Children Can Learn Financial Literacy Early and Often

Looking for a summer project for your children? Teach them financial literacy this summer… and next summer, and the following summer, and so on.

There is a range of sophistication of financial literacy, and we can help our children learn the basics early, and then help them grow and feel comfortable with the concepts and jargon over the years. Normalizing conversations about money, budgeting, and planning can be powerful tools to allow children to realize that financial planning is akin to other positive habits like good diets, getting enough sleep or routinely doing homework.

Get Started

Good old board games are an excellent first step in teaching financial literacy to young ones. Even games like Candyland: your card says 3 steps, and you can only go 3 steps. As children get older, the obvious choices are Monopoly, Life, or Yahtze. The power in these games comes with your narrative about following the rules or even helping your children plan a strategic move a few rolls of the dice in advance.

Teach by Example

Adopt a family philosophy and teach by example. Establish a rough guideline for how much money is appropriate to save, spend and donate.

moreThe Importance of a Certified Divorce Financial Analyst® in Your Pre-divorce Advisory Team

Divorcing couples have many questions which their attorney, CPA, and financial planner are unequipped to answer.

Examples may include:

1) How do we value and divide property? How do you calculate capital gains from selling the marital home? This is an important evaluation to undertake before approaching an attorney or CPA, who have the responsibilities of facilitating the division of assets, not evaluating the value of assets.

2) How do we divide retirement funds and pensions? What are the tax implications and how are the funds going to be used? How do you ensure equitable distribution in light of potential tax implications? What if there is dividing stock?

3) What happens if a paying ex-spouse dies? How do you think in advance about changes in life insurance or wills? Inheritance to children?

Lawyers provide guidance on executing a divorce in accordance with state laws, they are not equipped to provide guidance on financial planning. Likewise, accountants typically focus on the present-day scenario and financial planning practitioners help to map out future goals.

Craig Robson, CFP®, CIMA®, CDFA®, Founding Principal and Managing Director of Regent Peak Wealth Advisors has undergone specific training and earned his Certified Divorce Financial Analyst® designation to assist in decoupling assets and specifically with regard to asset division, spousal maintenance and child support.

moreImportant Reminder for Protecting Your Private Information

During times of marketplace uncertainty, bad actors smell opportunity. The fall of Silicon Valley Bank and the resulting nervousness in the marketplace could trigger unscrupulous operators to engage with you to try to get you to reveal your private and personal information, particularly related to your banking practices.

Things to beware of include:

Scammers might attempt to impersonate trusted banking brands or cyber security companies in an effort to get you to reveal your personal information.

Phishing campaigns could lure people into opening links or attachments that include malware that allows them access to your personal information.

Scams often rely on compelling content and urgency that encourage you to provide your login information or login to your accounts through a provided link or phone someone on a phone number provided in the email.

What should you do?

Have your guard up! If you receive an unexpected or even mildly suspicious email from your bank, do not click on anything in the email. Login to your account separately and find a customer service number and call the bank independently of the email you received and ask whether the email was legitimate.

more

Evaluating Risk in A Recession

Investor sentiment can be influenced in a variety of ways, and when one is thinking about how to manage a portfolio during a recession, it’s important to recognize what information is truly important vs what is just noise. Media and other speculative forces can push sentiment in directions that don’t always follow the data.

So, what exactly is a recessionary market? The commonly-accepted definition of recession is when there are two consecutive quarters of negative GDP [1]. Those data sets aren’t officially released by the United States Bureau of Economic Analysis until two quarters after the fact, (for reference, Q3 of 2022 was negative but Q4 of 2022 was positive), so while we don’t know yet how the first half of 2023 will pan out, here are a few things to consider, in general, about recessionary markets.

Cash deposits are common “go-to’s” in a recession, but there are a few different approaches to holding cash with slightly different levels of risk associated with each. First, there are FDIC insured cash deposits. The FDIC protects depositors of insured banks located in the United States against the loss of their deposits if an insured bank fails. Any person or entity can have FDIC insurance coverage in an insured bank up to $250,000 per individual or entity. [2]

moreThe WIIFM of Developing a Financial Plan

Taking the time to pull together a financial plan may sound onerous. If you embark on the effort, your initial thought is, “There has got to be a return on the investment of my time,” right? At Regent Peak, we believe there are MANY benefits to a financial plan, but below are our Top Five:

1. It gives you short and long-term goals to be working towards.

We have a lot of runners among our Regent Peak Wealth Advisors’ team. None of them would consider signing up for a race without the intent of training. They recognize before they can actually run a race from start to finish - whether it's 5 km, 10 km, a half or full marathon - they need to build their stamina and ability over time. It’s the same with investing. It takes time to accomplish your long-term goal, and you can’t achieve that without setting and achieving the short-term goals first.

2. A financial plan can help you regulate the discipline of saving.

By including short-term goals in your plan, you create a cadence and routine for saving that, for many, becomes the foundation for future investments. Small nest eggs of savings, that receive regular and incremental deposits, allow you to see how funds can accumulate and grow. Seeing savings accumulate provides encouragement and reinforces the value of maintaining the routine.

moreCraig's Corner - What's Most Important

Craig Robson, CFP®, CIMA®, CDFA®, Founding Principal and Managing Director

During a recent conversation with one of my teenage boys while driving him to school, he commented that he felt I was a risk-taker compared to his friends’ fathers. I was somewhat caught off guard with this unexpected comment so I asked him to elaborate. To paraphrase, he responded, for example: 1) you were building your new business during the pandemic, 2) you and Mom are building a new home during a time of economic uncertainty, and 3) you continue to play competitive ice hockey even after you tore your ACL two years ago and went through surgery and 10 months of PT. I smiled and responded that he may be correct! After a healthy dialogue, I told him that I choose to take strategic risks in life because, in my view, the benefits over the long term are greater than the pain points I may have to experience in the short term. One could make the same case for investing.

As of March 3, 2023 the S&P 500 and Nasdaq 100 were up 5.69% and 12.54% respectively YTD, while over the past 12 months those same two indices declined by 5.72% and 11.80% respectively [1]. Investing one’s hard-earned savings in the capital markets is best suited for longer-term goals as we must accept, and may experience, volatility (i.e. pain points) in the shorter-term. And while it’s important to track the overall performance of your investments, in my view what’s more important is the future goals which one will have more confidence in achieving (i.e., buying a 2nd home, having the resources to pay for educational costs, living a comfortable retirement lifestyle, traveling, etc.) due to taking appropriate levels of risk with your capital.

moreWhat Should A New Client Expect During the Onboarding Process at Regent Peak?